While Less Than One-Third of Parents Say Children are Confident about this Fall, 77% of Parents are Still Saving for College

Fidelity® College Savings Indicator Finds Parents on Track to Meet Just 33% of College Savings Goal Despite Concerns about COVID-19 and Distance learning, Most Parents Agree College is Still Worth the Cost

With the cost of college continuing to rise amidst a pandemic that’s causing many Americans’ wallets to take a hit, are parents still preparing to pay for their children’s college education? Fidelity’s College Savings Indicator Study has tracked savings habits for over a decade, and while this year’s study finds more parents saving than ever before, 71% are concerned about COVID-19’s impact on their ability to save.

Nearly one-third (32%) are not even sure what college will cost by the time their children enroll.

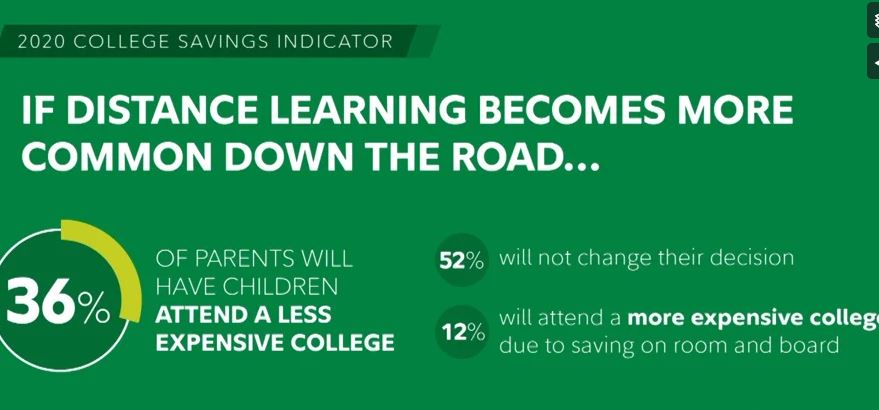

Parents and children share anxiety about educational disruptions this fall, with two-thirds agreeing that in-person instruction is the best way for their children to learn, an unlikely scenario for many students this year. If distance learning becomes more common down the road, 36% of parents say they will have their child attend a less expensive college since they would not want to pay full tuition for virtual classes.

Despite these concerns, the study reveals 77% of parents agree college is worth its cost. So, what does your audience need to know to improve their college savings outlook during these challenging times?

John Boroff, director of retirement and college leadership at Fidelity Investments, discusses the findings of this year’s study, including how COVID-19 is impacting parents’ savings priorities.

This segment is brought to you by Fidelity Investment

About the Fidelity Investments 2020 College Savings Indicator Study

As part of the study, Fidelity conducted a survey of parents with college-bound children of all ages. Parents provided data on their current and projected household asset levels including college savings, use of an investment advisor and general expectations and attitudes toward financing their children’s college education.

Using Fidelity’s proprietary asset-liability modeling engine, the company was able to calculate future college savings levels per household against anticipated college costs. The results provided insight into the financial challenges parents face in saving for college. Data for the Indicator (number of children in household, time to matriculation, school type, current savings and expected future contributions) was collected by Boston Research Technologies, an independent research firm, through an online survey from June 5 – July 2, 2020 of 1,790 families nationwide with children aged 18 and younger who are expected to attend college.

The survey respondents had household incomes of at least $30,000 a year or more and were the financial decision makers in their household. College costs were sourced from the College Board’s Trends in College Pricing 2019. Future assets per household were computed by Fidelity Personal and Workplace Advisors LLC (FPWA), a registered investment adviser and a Fidelity Investments company. Within Fidelity’s asset-liability model, Monte Carlo simulations were used to estimate future assets at a 75 percent confidence level. The results of the College Savings Indicator may not be representative of all parents and students meeting the same criteria as those surveyed for the study.

About Fidelity Investments Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $8.6 trillion, including discretionary assets of $3.4 trillion as of July 31, 2020, we focus on meeting the unique needs of a diverse set of customers: helping more than 32 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money.

Privately held for more than 70 years, Fidelity employs more than 45,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

# # #

Fidelity Brokerage Services LLC, Member NYSE, SIPC 900 Salem Street, Smithfield, RI 02917

944575.1.0

© 2020 FMR LLC. All rights reserved.